A Small Stock Dividend Reduces Retained Earnings Using Which Value

A companys board of directors may increase dividends and stock repurchases to reduce available cash and decrease_____. Retained earnings is not reduced because the dividend is immaterial.

Increase in common stock.

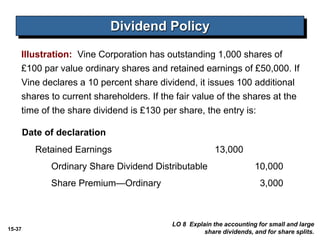

. Par value of the dividend B. -less than 25 the fair value of the additional shares distributed is transferred from retained earnings to paid-in capital. For small stock dividends by what amount are retained earnings reduced.

The total value of the shares 150000 is deducted from retained earnings. Retained earnings is reduced to the par value of the stock. Dividends also do not appear on the income statement.

Decrease in cash D. Market value of the dividend. A decrease in capital investments.

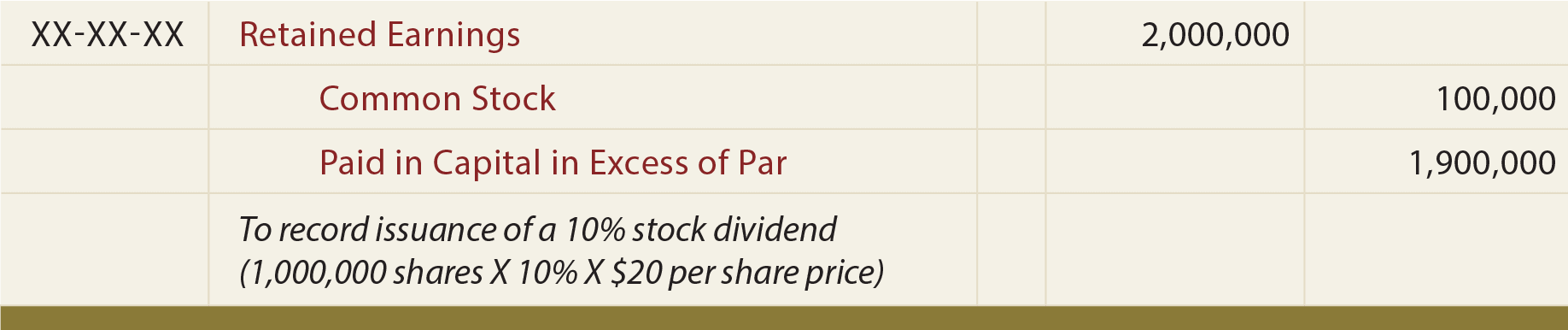

Book value of. Retained earnings 200000520 20000 Common stock 20000055 5000. Common Stock 200000 Retained Earnings 180000 C.

Market value of the dividend See answers. For small stock dividends by what amount are retained earnings reduced. The two entries would include a 200000 debit to retained earnings and a 200000 credit.

Par value of the stock D. Of this amount 10000 is allocated to the common stock. Consequently Retained Earnings should be debited for the market value of the stock.

Each share has a par value of 1 and a market price of 15. Small stock dividend journal entry. Decrease in capital in excess of par value E.

Decrease in total owners equity C. Retained Earnings Opening Retained Earnings Profits Dividends. A higher estimated cash flow.

This is because they serve fundamentally different purposes. Instead it lowers the amount that companies can transfer to the retained earnings account. A possible sell off of valuable assets.

When there is a stock dividend you should transfer from retained earnings to the capital stock and additional paid-in capital accounts an amount equal to the fair value of the additional shares issued. A small stock dividend is treated as if it is a cash dividend reinvested in capital stock. Par value of the stock B.

If each share is currently worth 20 on the market the total value of the dividend would equal 200000. Which one of the following is a result of a small stock dividend. Book value of the dividend D.

The market value of the original shares plus the newly issued shares is the same as the market value of the original shares before the stock. Even if the dividend is issued as additional shares of stock the value of that stock is deducted. When a stock dividend is small for example a 10 stock dividend a.

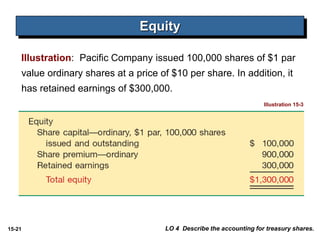

However a cash dividend results in a straight reduction of. Cash 380000 Common Stock 380000 D. Par value of the stock.

Retained earnings is reduced by the fair value of the stock. Book value of the dividend C. For small stock dividends by what amount are retained earnings reduced.

Cash 380000 Common Stock 200000 Paid-in Capital in Excess of Par Value 180000. Small stock dividends Retained earnings reduced by par value of stock Large from BTA 112 at LaGuardia Community College CUNY. Cash dividends have a slightly different effect on the balance sheet in that they reduce both cash and retained earnings accounts by an amount equal to the size of the dividend.

Par value of the dividend B. A stock dividend is considered small if the shares issued are less than 25 of the total value of shares outstanding before the dividend. A journal entry for a.

Stock dividends have no effect on the total amount of stockholders equity or on net assets. The amount reclassified depends on the size of the stock dividend. They merely decrease retained earnings and increase paid-in capital by an equal amount.

The credits should be recorded in Capital Stock and Capital in Excess of Par. Paid-in capital in excess of par value is unaffected. The fair value of the additional shares issued is based on their market value after the dividend is declared.

Both small and large stock dividends cause an increase in common stock and a decrease to retained earnings. Capitalize them at market price EG Assume a firm has 20000 shares of 5 par common stock outstanding and declares a 5 stock dividend when the market price is 20 per share. This is a small stock dividend because 5 is less than 20-25.

Both cash and stock dividends reduce retained earnings by an amount equal to the size of the distribution. A small stock dividend is viewed by investors as a distribution of the companys earnings. Par value of the dividend C.

For small stock dividends by what amount are retained earnings reduced. For small stock dividends by what amount are retained earnings reduced. Immediately after the distribution of a stock dividend each share.

Therefore a dividend distribution does not impact a companys profits or reduce them. How to Account for a Small Stock Dividend. Increase in retained earnings B.

A firm might use higher dividends or stock repurchase to reduce______ costs.

Stock Splits And Stock Dividends Principlesofaccounting Com

Efinancemanagement Learn Accounting Accounting Student Accounting Principles

/BOA-f8957c5ee9c14788b59a7e5edd802a7b.jpg)

No comments for "A Small Stock Dividend Reduces Retained Earnings Using Which Value"

Post a Comment